Argentina

Cerro Bayo and La Flora Projects

Catalyst Summary

|

Cerro Bayo and La Flora are 100%-owned silver-gold projects located within the prolific Deseado Massif in Santa Cruz Province, Argentina. The projects are fully permitted and under option to Daura Gold Corp., to earn up to an 75% interest through staged payments and drilling. Irrevocable work commitments to be completed on or before April 30, 2026, are 50-line km of IP profiling, 150-line km of gradient array IP, and 1,500 meters of drilling. A total of 28,000m of drilling must be completed prior to the exercise of the Option. |

Expanded and Fully Permitted

Latin Metals has received environmental approvals authorizing drilling at Cerro Bayo.

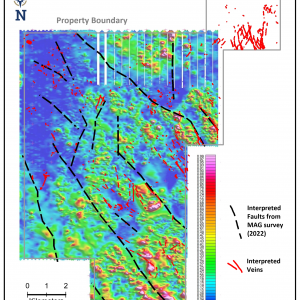

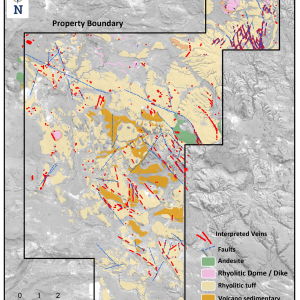

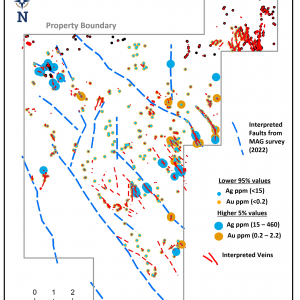

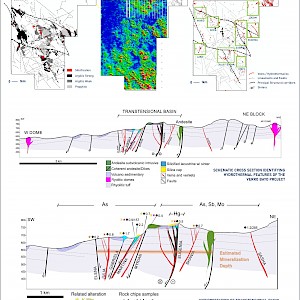

Historically, Barrick completed detailed geological mapping, alteration studies, a 102 line-km magnetic survey, and 133 line-km of gradient IP geophysics.

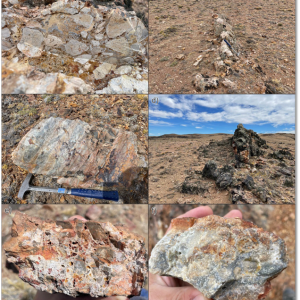

Ten high-priority drill targets have been identified, focused on structurally controlled outcropping veins and hydrothermal breccias. Surface sampling has returned grades up to 2.3 g/t gold and 600 g/t silver, with target depths for potential bonanza grade at 70m to 150m from surface.

Large, Untested Gold-Silver System

Located in the Deseado Massif—one of the world’s most productive precious-metal belts—Cerro Bayo and La Flora sit within a region that has produced more than 600 million oz silver and 20 million oz gold since the 1990s.

Mineralization is hosted within Jurassic-aged rhyolitic ignimbrites and domes, controlled by a regional trans-tensional fault system.

The projects cover 28,397 hectares and benefit from year-round road access from Gobernador Gregores and Perito Moreno, with nearby port and power infrastructure supporting exploration and potential development.

Historical Work

Previous exploration included mapping, sampling, extensive geophysical surveys, and historical drilling.

Adjacent to the project, historical drilling by Exeter Resources at the Verde Project returned values up to 310 g/t silver and 0.65 g/t gold over 2 metres.

Strategic Location & Infrastructure

The Deseado Massif hosts more than 30 mines and advanced exploration projects, including Newmont’s Cerro Negro Mine, Hochschild/McEwen’s San Jose Mine, and Patagonia Gold’s Cap Oeste Mine.

Cerro Bayo and La Flora are advantageously positioned within this world-class mining region, with strong community support and well-developed logistics.

Recent Developments

Option Agreement with Daura Gold Corp.

In 2025, Latin Metals entered into a binding Letter Agreement with Daura Gold Corp., granting Daura the right to earn up to an 80 % interest in Cerro Bayo and La Flora.

The partnership ensures near-term, partner-funded exploration with the first systematic drill program planned for Q1 2026.

Full Permitting Complete

Provincial authorities approved the Environmental Impact Assessment in March 2025, authorizing drilling and other surface exploration activities.

Partner-Funded Exploration

Ownership

Latin Metals has a vested 71% ownership of the Cerro Bayo and La Flora Properties, with a purchase agreement to purchase the remaining 29% for US $400,000, consolidating 100% ownership.

Optioned to Daura Gold Corp.

Under an option agreement, Daura Gold Corp. can earn up to an 80 % interest in Cerro Bayo and La Flora.

To earn an initial 75 %, Daura must make staged cash payments totaling US $ 1,700,000, assume US $ 400,000 in payments to the underlying vendor, complete 28,000 m of drilling, and deliver a NI 43-101 mineral resource estimate, over approximately 3 years.

Daura may then earn an additional 5 % (aggregate 80 %) by delivering the resource estimate and making a cash payment of US $ 7.00 per measured and indicated ounce and US $ 5.00 per inferred ounce.