Argentina

Organullo Project

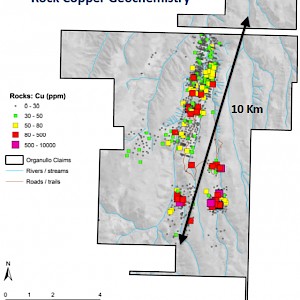

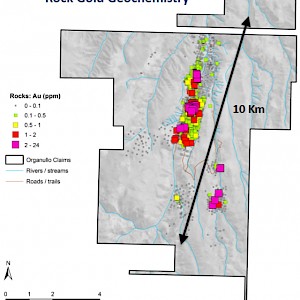

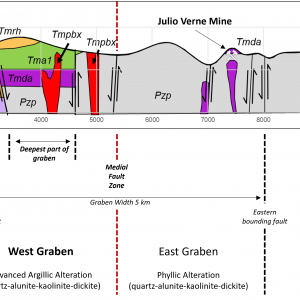

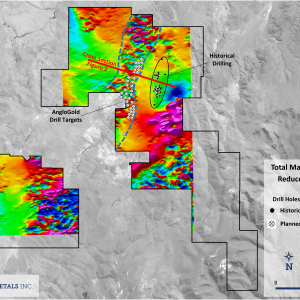

The Organullo Project is a 100%-owned exploration property located in Salta Province, northwest Argentina. The project has a large alteration and mineralization footprint with geochemical anomalies and targets over a 10km strike length making Organullo one of the largest untested geochemical anomalies in Argentina. The project was historically known as a gold exploration play with locally high-grade gold at surface and with historical small-scale mining having been recorded at the Julio Verne Mine in the 1930s. Gold potential remains a focus today but with newly recognized potential for copper porphyry systems.

Historical exploration includes approximately 10,000m of diamond and RC drilling, but only a small portion of the 10km strike length has been subject to exploration through drilling with most targets remaining untested.

Salta Province has seen a number of significant discoveries in recent years including the Taca Taca copper deposit (First Quantum) and the Lindero gold deposit (Fortuna Silver), both of which are moving towards development. The Organullo project is located closer to critical infrastructure, being just 20km south of the regional urban centre called San Antonio de los Cobres, 100km north of the Provincial capital Salta, and close to an electrical transmission line, rail line and gas pipeline.

As an exploration project, Organullo has multiple drill-ready targets as well as conceptual targets requiring additional surface exploration. Ultimately it requires significant drilling to test the potential of the project.

Partner-Funded Exploration

Ownership

Latin Metals owns the Organullo project 100%.

Optioned to AngloGold Ashanti

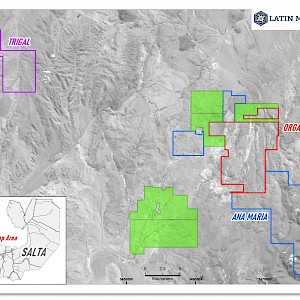

Latin Metals has entered into an option agreement with AngloGold Ashanti, who have optioned the Organullo, Trigal, and Ana Maria projects. AngloGold have an initial option to earn a 75% interest in the Organullo, Trigal, and Ana Maria projects collectively through cash payments of US$2,575,000 and exploration expenditures of US$10,000,000 over 5 years. AngloGold will have a second option to earn an additional 5% (aggregate 80%) interest by delivering an independent NI 43-101 Mineral Resource estimate and making a cash payment equal to US$4.65 per gold equivalent ounce of Measured and Indicated resource defined.