Argentina

Zaha

The Esperanza project is an advanced, drill-ready, copper-gold exploration project, located in San Juan Province, Argentina. The project includes the Esperanza property and the Huachi property. The project is at relatively low elevation of 3,000m, 35km from power lines and only 135km north of the Provincial Capital San Juan. San Juan Province is a mining jurisdiction which is host to large gold mines and world class copper deposits.

Latin Metals has an option to earn a 100% interest in the Esperanza and Huachi properties, subject to NSR royalties in favour of the underlying owners.

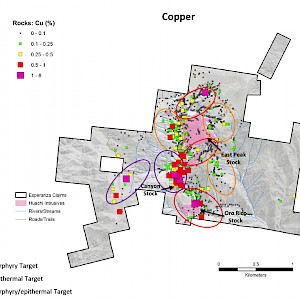

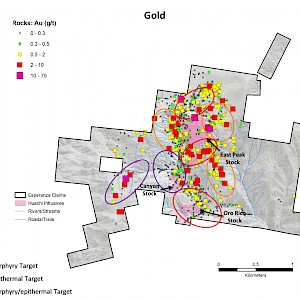

The Esperanza property consists of an outcropping copper-gold porphyry system, juxtaposed beside a gold epithermal system. Rock sampling at surface provides a sense of the system dimensions and highlights that both high-grade gold and copper occur at surface.

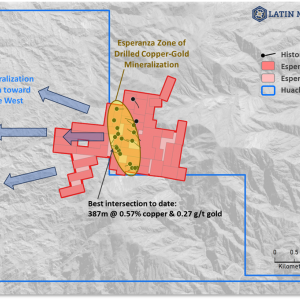

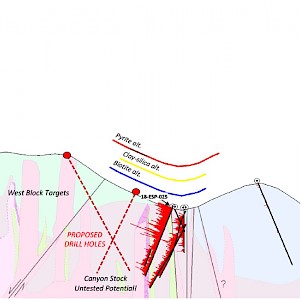

Historical exploration includes 8,500m of diamond drilling. The copper-gold porphyry system is exposed over a large area and is defined by drill holes which intersect mineralization from surface to a depth of approximately 400m. In 2018, Latin Metals' exploration returned the best drill hole to date; 387m grading 0.57% copper and 0.27 g/t gold, intersected from surface and open at depth.

The mineralization at Esperanza is open to the west, where outcropping porphyry mineralization is covered by a thin veneer of younger volcanic rocks. Mineralization is interpreted to extend westward as evidenced by discreet windows with outcropping mineralized veins. The acquisition of the contiguous Huachi property significantly expands the project footprint and secures the property to the west where expansion potential needs to be tested by additional drilling.

Project Highlights

- Copper-endowed district with 11 known copper deposits - 175km from Filo del Sol deposit

- Best intersect to date: 387m @ 0.57% copper & 0.27g/t gold intersected from surface

- Open at depth and laterally – underexplored and not tested below 400m

- Copper-gold porphyry system juxtaposed with epithermal gold – telescoping likely

- Critical mass of exploration data – 24 drill holes for 8,500m, geochemistry, and geophysics. Drill-ready.

- Up to 6% copper and numerous +1% rock samples at surface

- Very large alteration system and pyrite halo exposed at surface

- Road accessible, low elevation, year-round project

| Drillhole | Azimuth | Dip | From (m) |

To (m) |

Interval (m) |

Copper (%) |

Gold (g/t) |

|---|---|---|---|---|---|---|---|

| 18-ESP-025 | 280 | -67 | 0 | 387 | 387 | 0.57 | 0.27 |

| including | 0 | 368 | 368 | 0.59 | 0.28 | ||

| including | 0 | 232 | 232 | 0.74 | 0.33 |

Partner-Funded Exploration

Ownership

Latin Metals has an option for 100% ownership of the Esperanza & Huachi Property.

Optioned to Moxico Resources

Latin Metals has entered into a binding letter agreement with Moxico Resources, who have optioned the Esperanza and Huachi copper-gold projects. Moxico has an initial option to earn a 75% interest in the Esperanza and Huachi projects collectively through cash payments totaling US$2,775,000, assumption of US$4,633,000 in earn-in obligations, completion of 65,000 meters of drilling (first 5,000m is a firm commitment) and delivery of NI 43-101 technical reports, including a Bankable Feasibility Study. Thereafter, Moxico will have a top-up right whereby Moxico can earn an additional 25% (aggregate 100%) interest by making a cash payment of US$10,000,000 or US$0.02 per pound of copper equivalent in the Measured and Indicated resource categories, whichever is greater. If Moxico top up to 100%, Latin Metals shall revert to a 2% NSR royalty.

If Moxico do not top-up, a 75:25 joint venture shall be formed. If the participating interest of either party falls below 10%, the interest of such party shall be converted to a 1% NSR royalty. In addition, if at any time while Latin Metals holds a 10% or greater participating interest, it shall have the option, exercisable at its discretion, to revert to a 2% NSR royalty.

OWNERSHIP

Option for Esperanza Property

Latin Metals has an option for 100% ownership of the Esperanza Property.

Latin Metals has an option to acquire a 100% interest in the Esperanza project through payment of US$2,306,000 in cash and issuance of Latin Metals shares valued at US$500,000. Upon exercising the option, Latin Metals 100% ownership interest in Esperanza will be subject to a 2% NSR royalty. The nsr royalty can be reduced to 1.5% by purchasing 0.5% of the NSR for US$1,000,000 at any time.

Option for Huachi Property

Latin Metals has an option for 100% ownership of the Huachi Property.

Latin Metals has an option to acquire up to a 100% ownership interest in the Huachi Property. To earn a 75% interest, Latin Metals must spend US$1,000,000 on exploration and pay US$1,000,000 to Golden Arrow over four years. Upon fulfilling these terms, Latin Metals can exercise its top-up right to purchase the remaining 25% for US$2,000,000 within 90 days, achieving full ownership and reducing Golden Arrow's interest to a 1% NSR royalty. If Latin Metals chooses not to exercise the top-up right, a joint venture will be formed, with Latin Metals holding 75% and Golden Arrow 25%. If either party dilutes to 15% or less, the interest of that party converts to a 1% NSR royalty.