Vancouver, British Columbia – Centenera Mining Corporation (“Centenera” or the “Company”) - (TSXV: CT, OTCQB: CTMIF) announces that pursuant to a previous news release dated September 5, 2018 (NR18-11), the Company has signed three definitive option agreements (the “Option Agreements”) whereby, subject to TSX Venture Exchange approval, Centenera will be granted the right to acquire up to a 100% interest in eight precious metals properties (the “Properties”) from an arm’s length party, Tres Cerros Exploraciones S.R.L (“Tres Cerros”). The Properties are all located within the highly prospective Deseado Massif in Santa Cruz Province, Argentina, and together comprise more than 30,000 hectares. Under the terms of the Option Agreements, Centenera will be granted an exclusive option (the “Option”) to acquire a 100% interest in the Properties by way of staged cash and common share payments, subject to a net smelter returns (“NSR”) royalty in favour of Tres Cerros.

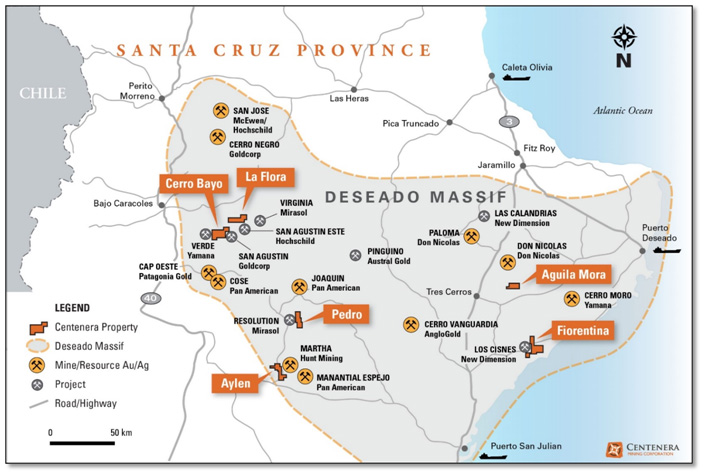

The Properties are all located within the prospective Deseado Massif (Figure 1). The Deseado Massif is a Jurassic age volcanic plateau covering 60,000km2 and hosting valuable epithermal precious metals deposits.

Figure 1: Location of Santa Cruz Properties relative to mining and exploration projects in Santa Cruz Province

It is intended that, moving forward, the Properties will be an exploration priority for the Company. As stated previously, the Company intends to retain a highly experienced consultant who is recognized as a global expert in these types of deposits, and who has specific experience in the Deseado Massif, having completed review work for many of the major mining companies working in the area. If retained, the primary objective of the consultant will be to review each of the Properties on the ground and to rank them in terms of exploration priority. Initial work is anticipated to focus on detailed mapping, where allowed by exposure, ground geophysics and surface geochemistry, and specific exploration recommendations will drive the subsequent programs.

The Option Agreements provide that, subject to certain conditions, including TSX Venture Exchange (“TSX-V”) acceptance, Centenera will be granted the Option to acquire a 100% interest in the Properties, subject to a NSR royalty in favour of Tres Cerros. The three Option Agreements relate to the property groups set out below (“Property Groups”) as follows:

| Property Group | Properties |

|---|---|

| Property Group #1 | Cerro Bayo & La Flora Properties |

| Property Group #2 | Aylen, Aylen Oeste & Pedro Properties |

| Property Group #3 | Fiorentina, Fiorentina Norte & Aguila Mora Properties |

During the Option period, Centenera will be responsible for maintaining the exploration concessions and permits comprising the Properties in good standing, and paying all fees and assessments, and taking such other steps required to do so. There will be no other work commitments, and any work carried out on the Properties will be at the sole discretion of Centenera.

The Option will be structured as a two-stage option, whereby Centenera can earn an initial 80% interest (the “First Option”), followed by the remaining 20% interest (the “Second Option”), subject to certain royalty conditions. The aggregate acquisition cost of the First Option for all three Property Groups will be USD $2,887,500 payable in cash, and common shares in the capital of Centenera issued to Tres Cerros having a deemed issuance value of USD $3,675,000, over a period of 6 years.

The earn-in terms for the First Option (for each of the Property Groups) will be as follows (all dollar amounts are US Dollars):

| Date | Cash Payments | Centenera Shares | NI 43-101 Report | Cumulative Earned Interest |

|---|---|---|---|---|

| 5 business days from TSX-V acceptance of the Definitive Agreement (the “Effective Date”) | $12,500 | -- | -- | -- |

| First anniversary of the Effective Date | $25,000 | $50,000 | -- | -- |

| Second anniversary of the Effective Date | $50,000 | $75,000 | -- | -- |

| Third anniversary of the Effective Date | $75,000 | $100,000 | -- | 35% |

| Fourth anniversary of the Effective Date | $100,000 | $200,000 | -- | 51% |

| Fifth anniversary of the Effective Date | $200,000 | $300,000 | -- | 71% |

| Sixth anniversary of the Effective Date | $500,000 | $500,000 | Technical Report | 80% |

| TOTAL: | $962,500 | $1,225,000 | -- | -- |

As part of the earn-in commitment for each Property Group, Centenera will be required to deliver to Tres Cerros a single technical report in accordance with NI 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”), with the subject property being the more advanced of the Properties in each of the Property Groups. Other than the initial $12,500 cash payment (aggregate $37,500 for all the Property Groups), Centenera will not be obligated to make any payments or issue any stock to Tres Cerros.

For a period of 120 days after the exercise of the First Option for each Property Group, Centenera will have the Second Option to acquire the remaining 20% (aggregate 100%) interest in that Property Group, by making a cash payment of $400,000 and issuing shares in the capital of Centenera valued at $400,000 to Tres Cerros, subject to a 0.75% NSR royalty, of which two-thirds of the royalty (0.5%) can be purchased at any time for $1,000,000.

If Centenera elects not to exercise the Second Option, the parties will be deemed to have entered into a joint venture (“JV”), with the initial participating interests of Centenera being 80% and Tres Cerros being 20%. In the event that either party’s participating interest falls below 10% then that party’s interest will be converted to a 1% NSR royalty, one half of which (0.5%) can be purchased by the other party for $1,000,000.

Qualified Person

Keith J. Henderson, P.Geo., is the Company's qualified person as defined by NI 43-101 and has reviewed the scientific and technical information that forms the basis for portions of this news release. He has approved the disclosure herein. Mr. Henderson is not independent of the Company, as he is an employee of the Company and holds securities of the Company.

About Centenera Mining Corporation

Centenera is a mineral resource company trading on the TSX-V under the symbol “CT” and on the OTCQB exchange under the symbol “CTMIF”. The Company is focused 100% on mineral resource assets in Argentina, which include gold, silver, copper-gold and lithium assets. Centenera’s assets are located in Salta, San Juan and Santa Cruz Provinces, which are widely recognized as being favourable jurisdictions for mining and exploration.

On Behalf of the Board of Directors of

CENTENERA MINING CORPORATION

"Keith Henderson"

President & CEO

For further details on the Company readers are referred to the Company's web site (www.centeneramining.com) and its Canadian regulatory filings on SEDAR at www.sedar.com.

For further information, please contact:

Keith Henderson

Phone: 604-638-3456

E-mail: info@centeneramining.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and U.S. securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the negotiation of the Option Agreements and exercise of the Option for the Properties, the anticipated content, commencement, timing and cost of exploration programs in respect of the Properties and otherwise, anticipated exploration program results from exploration activities, and the Company's expectation that it will be able to enter into agreements to acquire interests in additional mineral properties, the discovery and delineation of mineral deposits/resources/reserves on the Properties, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "expects", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, that it will be able to negotiate the Option Agreements and that it will obtain TSX-V acceptance for filing of thereof, market fundamentals will result in sustained precious metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future development of the Company’s Argentine projects in a timely manner, the availability of financing on suitable terms for the development, construction and continued operation of the Company projects, and the Company’s ability to comply with environmental, health and safety laws.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks and other factors include, among others, operating and technical difficulties in connection with mineral exploration and development and mine development activities at the Properties, including the geological mapping, prospecting and sampling programs being proposed for the Properties (the "Programs"), the fact that the Company’s anticipated interests in the Properties will only be an option and there is no guarantee that such interest, if earned, will be certain, actual results of exploration activities, including the Programs, estimation or realization of mineral reserves and mineral resources, the timing and amount of estimated future production, costs of production, capital expenditures, the costs and timing of the development of new deposits, the availability of a sufficient supply of water and other materials, requirements for additional capital, future prices of precious metals and copper, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, possible variations in ore grade or recovery rates, possible failures of plants, equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, delays or the inability of the Company to obtain any necessary permits, consents or authorizations required, including TSX-V acceptance for filing of the Option Agreements, any current or future property acquisitions, financing or other planned activities, changes in laws, regulations and policies affecting mining operations, hedging practices, currency fluctuations, title disputes or claims limitations on insurance coverage and the timing and possible outcome of pending litigation, environmental issues and liabilities, risks related to joint venture operations, and risks related to the integration of acquisitions, as well as those factors discussed under the heading "Risk Factors" in the Company's latest Management Discussion and Analysis and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company's profile on the SEDAR website at www.sedar.com.

Readers are cautioned not to place undue reliance on forward looking statements. Except as otherwise required by law, the Company undertakes no obligation to update any of the forward-looking information in this news release or incorporated by reference herein.

-30-