Vancouver, British Columbia - Centenera Mining Corporation (the "Company") - (TSXV: CT, OTCQB: CTMIF), announces that it has entered into a binding Letter of Intent (the "LOI") with an arm's length vendor (the "Vendor") whereby it has been granted the exclusive option (the "Option") to acquire a 100% interest in the Huachi Copper-Gold Porphyry Deposit ("Huachi" or the "Project"). The Project is located in the Province of San Juan in northwest Argentina and consists of 32 mining claims ("Minas") totalling 462 hectares.

Project Highlights

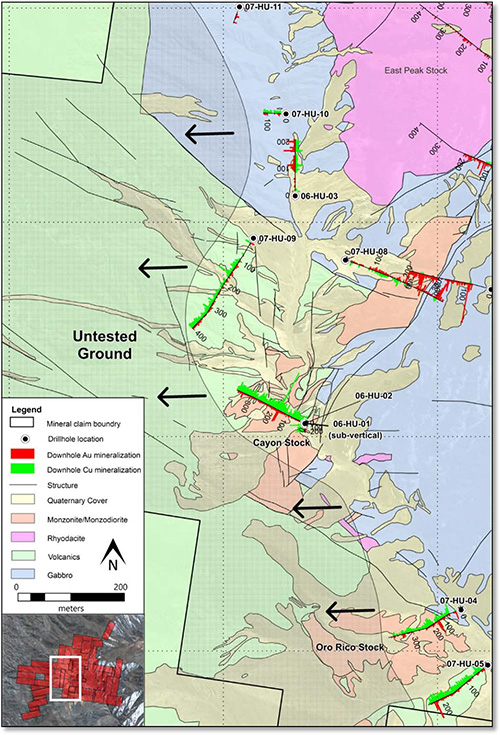

The Project consists of a central copper-gold porphyry deposit with a peripheral epithermal gold system located to the east. Centenera will initially focus on exploration of the copper-gold porphyry deposit and the extensive open ground to the west, targeting a large-scale, bulk-tonnage copper-gold porphyry deposit. The copper-gold porphyry deposit has been tested with a total of 7 historical diamond drill holes (totalling 2,011 meters) (Figure 1).

Highlights:

- All drillholes targeting porphyry style mineralization intersected copper-gold mineralization.

- Majority of drillholes terminated in mineralization and are open at depth.

- Several drillholes demonstrate increasing grade with depth.

- Mineralization is open in all directions, in particular to the west and north where porphyry style alteration is mapped at surface and untested by drilling.

Drilling highlights include:

| Drillhole | From (m) | To (m) | Interval (m)(1) | Copper (%) | Gold (g/t) | Copper Equivalent(2) |

|---|---|---|---|---|---|---|

| 06-HU-01 | 1 | 200 | 199.0 | 0.25 | 0.12 | 0.35% |

| incl. | 15 | 123 | 108.0 | 0.32 | 0.15 | 0.44% |

| 06-HU-02 | 2 | 355.1 | 353.1 | 0.35 | 0.185 | 0.49% |

| incl. | 112 | 355.1 | 243.1 | 0.40 | 0.21 | 0.57% |

| 07-HU-05 | 6 | 254.5 | 248.5 | 0.26 | 0.17 | 0.40% |

| incl. | 126 | 244 | 118.0 | 0.34 | 0.22 | 0.51% |

| incl. | 192 | 244 | 52.0 | 0.39 | 0.32 | 0.64% |

Notes:

1 True width is not known. 2.Copper equivalent = Copper grade % x (0.795 x gold grade g/t), where the conversion factor of 0.795 is calculated by comparing the value of 1 tonne of copper ore (at copper prices of $2.20/lb ($4,850.16/t)) to the value of 1 tonne of gold ore (at $1,200/oz ($38.58g/t)) and assuming 100% recovery.

"The acquisition of the Huachi copper-gold deposit has been a long-term objective for Centenera and we are delighted to have reached mutually acceptable terms with the underlying owners. Historical drilling has already defined part of the porphyry system and this work really helps to reduce exploration risk for Centenera shareholders," stated Keith Henderson, Centenera's President and CEO. "Porphyry deposits in Argentina have a history of creating value for shareholders and we believe that our planned drilling could help create similar value."

Figure 1: Geology at Huachi. Copper mineralization extends from the southern Oro Rico stock, north through the Canyon stock and then extends northward. All of the property to the west is untested by drilling and is considered highly prospective for additional copper-gold mineralization. The map presents all data considered relevant to Centenera's planned copper-gold porphyry exploration. The area covered by the map does not include all historical drilling.

Plan Going Forward

Subject to satisfactory completion of due diligence by the Company and acceptance of filing of the grant of the Option by the TSX Venture Exchange (the "TSXV"), Centenera and the Vendor will enter into and execute a definitive property option agreement (the "Option Agreement"). The Company has retained Discovery Consultants to complete a National Instrument 43-101 Technical Report for the Project, which will be completed within 45 days. No additional exploration is necessary before drilling and the Company's exploration manager is working to finalize drill targets, project logistics and drill permits.

Property Details

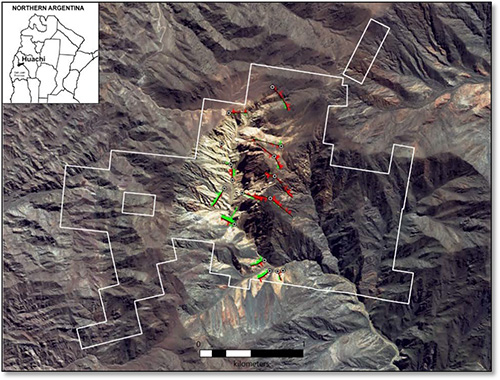

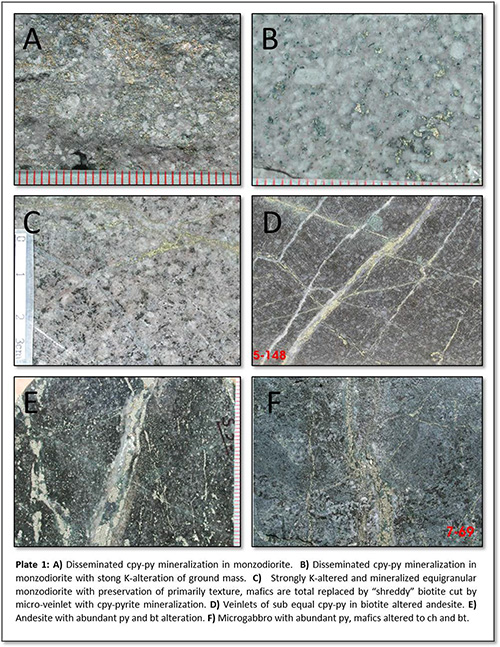

The Huachi copper-gold mineralization is associated with a porphyry-epithermal system with extensive multiphase quartz-stockwork development. Porphyry style alteration is within probable late Miocene intermediate to felsic stocks and dykes of the Huachi intrusive complex. Alteration consists of a central potassium silicate alteration zone characterized by pervasive groundmass replacement with local secondary biotite. This pervasive and intense alteration is clearly visible in satellite imagery as a pale colour anomaly (Figure 2). Additionally, there are narrow structurally controlled silicification zones within the central part of the system that are often associated with quartz-sericite-pyrite altered porphyry dykes. Additionally, early formed, pervasive secondary biotite is extensively developed within the alteration halo.

Historical exploration work on the property identified porphyry style copper mineralization which is best developed around two intrusive stocks: the Canyon stock, and the Oro Rico stock (Figure 1). Both stocks have mineralization at surface consisting of chalcopyrite, accompanied by disseminated magnetite, minor pyrite, and local sparse bornite and molybdenum. Additionally, a large 1,400m by 850m elongate >3% pyrite halo overlies the prospect suggesting significant porphyry mineralization may remain untested under cover.

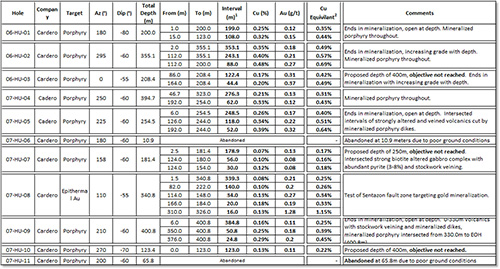

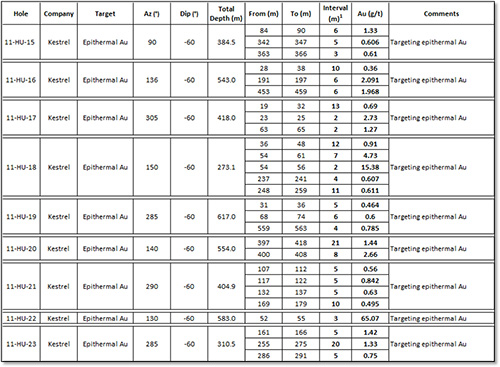

Historical exploration includes detailed geological and alteration mapping, surface rock sampling, a geophysical induced polarization survey to the west of known mineralization as well as 20 diamond drillholes (totalling 6,640 meters). Historical drilling in 2006-2007 consisted of 11 drillholes for 2,552 metres. Drilling was focussed on testing copper-gold porphyry mineralization (7 drillholes, Plate 1) with an initial test for epithermal gold mineralization (2 drillholes) and two drillholes were abandoned due to poor rock conditions. Later drilling from 2011to 2012 consisted of 9 drillholes for 4,088 metres and was focussed exclusively on exploration within the peripheral epithermal gold system.

Figure 2: Huachi Property Location and all historical drillholes.

The Huachi property is located in San Juan Province in northwestern Argentina (Figure 2), 135km due north of the city of San Juan. The Project consists of 32 Minas totalling 462 hectares. Associated with the Project are 10 demacias, which under Argentinean mining legislation, are defined as areas that are too small to be issued as separate claims and that are surrounded by existing claims. Once applications for the demacias have been finalized they will be incorporated into the Project, which together with 10 demasias, will total 516 hectares. Elevations at Huachi range from 2800 to 3250 meters above sea level and the Project is accessible by road, although some additional road development will be necessary on the property. Exploration can be conducted year-round.

Commercial Terms

Under the Option, Centenera has the right to earn a 100% interest in the Project through the payment of USD $2,306,000 and the issuance of common shares in the Company valued at USD $500,000 (at the time of issuance) to the Vendor, as follows:

| Date | Cash (USD) | Value of Shares (USD) |

|---|---|---|

| Effective Date | $80,000 | - |

| 15 December 2017 | $83,000 | - |

| 15 June 2018 | $90,000 | - |

| 15 December 2018 | $105,000 | - |

| 15 June 2019 | $106,000 | - |

| 15 December 2019 | $118,000 | - |

| 15 June 2020 | $120,000 | - |

| 15 December 2020 | $142,000 | - |

| 15 June 2021 | $142,000 | - |

| 15 December 2021 | $420,000 | $250,000 |

| 15 December 2022 | $900,000 | $250,000 |

| Total | $2,306,000 | $500,000 |

Upon completion of the Option payments and share issuances, Centenera will be deemed to have exercised the Option and will have earned an undivided 100% legal and beneficial interest in and to the Project, subject to a 2% Net Smelter Royalty ("NSR") to be granted to the Vendor. Centenera will have a right to buy back 0.5% of the NSR for USD $1,000,000, at which time the NSR payable to the Vendor shall be 1.5%. A finder's fee in the amount of USD $200,000, payable in shares, is payable by Centenera in connection with the acquisition of the Project.

During the Option period, Centenera will be responsible for maintaining the exploration concession and permits comprising the Project in good standing, and paying all fees and assessments, and taking such other steps, required in order to do so. There will be no other work commitments, and any work carried out on the Project will be at the sole discretion of Centenera.

Quality Assurance / Quality Control

The Huachi copper-gold porphyry drill testing was undertaken by Cardero Resource Corp. from 2006 to 2007. On site personnel at the project rigorously collected and tracked samples, which were then sealed and shipped to ALS Chemex for analysis. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025: 1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Quality control was further assured by the use of international and in-house standards. Blind certified reference material was inserted at regular intervals into the sample sequence by Cardero personnel in order to independently assess analytical accuracy. Finally, representative blind duplicate samples were forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control.

Drill testing of the epithermal gold system was undertaken by Kestrel Gold Inc. from 2011 to 2012. Diamond drill core was submitted to Alex Stewart Assayers Argentina S.A. in Mendoza, Argentina; an ISO 9000-2000 accredited laboratory. Gold and silver results were determined using standard fire assay techniques on a 30 gram sample with a gravimetric finish for gold and silver. In addition to this, ICP-AR (Aqua Regia digestion) analysis was performed on 38 elements. QA/QC performed by Kestrel included the collection of core duplicate samples, coarse reject samples and the insertion of certified reference samples (standards) and blanks. UAKO Geological Consultants supervised and assessed the QA/QC procedures and data in compliance with National Instrument 43-101 requirements.

The results of the copper-gold porphyry drill-testing are included in this news release as they will form the basis of Centenera's planned exploration. Results from Kestrel's drill program are partially included on Figure 1, but are not discussed in detail in this release. Results from all historical drilling are tabulated and included as Appendix I. Historical data was received from the underlying owners and includes assay certificates and QA/AC data.

Qualified Person

Tyler Caswell, P.Geo., the Company's Exploration Manager and a qualified person as defined by National Instrument 43-101, has reviewed the scientific and technical information that forms the basis for portions of this news release, and has approved the disclosure herein. Mr. Caswell is not independent of the Company, as he is an employee and holds incentive stock options.

APPENDIX I

Cardero Resource Corp. Historical Drilling 2006 to 2007

Kestrel Gold Inc. 2011 to 2012

On Behalf of the Board of Directors of

CENTENERA MINING CORPORATION

"Keith Henderson"

President & CEO

For further details on the Company readers are referred to the Company's website (www.centeneramining.com) and its Canadian regulatory filings on SEDAR at www.sedar.com.

For further information, please contact:

Keith Henderson

Phone: 604-638-3456

E-mail: info@centeneramining.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and U.S. securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the anticipated content, commencement, timing and cost of exploration programs in respect of the Project and otherwise, anticipated exploration program results from exploration activities, the Company's expectation that it will be able to enter into agreements to acquire interests in additional mineral properties, the successful negotiation and execution of a definitive Option Agreement for the Project, the discovery and delineation of mineral deposits/resources/reserves on the Project, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "expects", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward looking information. Such risks and other factors include, among others, operating and technical difficulties in connection with mineral exploration and development and mine development activities at the Project, including the geological mapping, prospecting and sampling program being proposed for the Project (the "Program"), actual results of exploration activities, including the Program, estimation or realization of mineral reserves and mineral resources, the timing and amount of estimated future production, costs of production, capital expenditures, the costs and timing of the development of new deposits, the availability of a sufficient supply of water and other materials, requirements for additional capital, future prices of precious metals and copper, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, possible variations in ore grade or recovery rates, possible failures of plants, equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, delays or the inability of the Company to obtain any necessary permits, consents or authorizations required, including TSXV acceptance, for the Property acquisition, or financing or in the completion of development or construction activities, changes in laws, regulations and policies affecting mining operations, hedging practices, currency fluctuations, title disputes or claims limitations on insurance coverage and the timing and possible outcome of pending litigation, environmental issues and liabilities, risks related to joint venture operations, and risks related to the integration of acquisitions, as well as those factors discussed under the heading "Risk Factors" in the Company's Management Information Circular (April 2016) and as discussed in the annual management's discussion and analysis and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company's profile on the SEDAR website at www.sedar.com.

Readers are cautioned not to place undue reliance on forward looking information. Except as otherwise required by law, the Company undertakes no obligation to update any of the forward looking information in this news release or incorporated by reference herein.