Vancouver, British Columbia -- Centenera Mining Corporation ("Centenera" or the "Company") - (TSXV: CT, OTCQB: CTMIF) reports that it has received a drill permit for its flagship Esperanza Copper-Gold Project (formerly known as the Huachi project) ("Esperanza" or the "Project") in San Juan Province, Argentina. The Company will commence site logistics work immediately and plans to begin diamond drilling as soon as possible (Figure 1).

The Company also announces a non-brokered private placement of up to 12,000,000 units (the "Units") priced at $0.18 per Unit to raise a total of up to $2.16 million. Each Unit will consist of one common share of Centenera and one warrant, with each warrant entitling the holder thereof to purchase one common share of Centenera at an exercise price of $0.30 for a period of 18 months from the closing of the Financing.

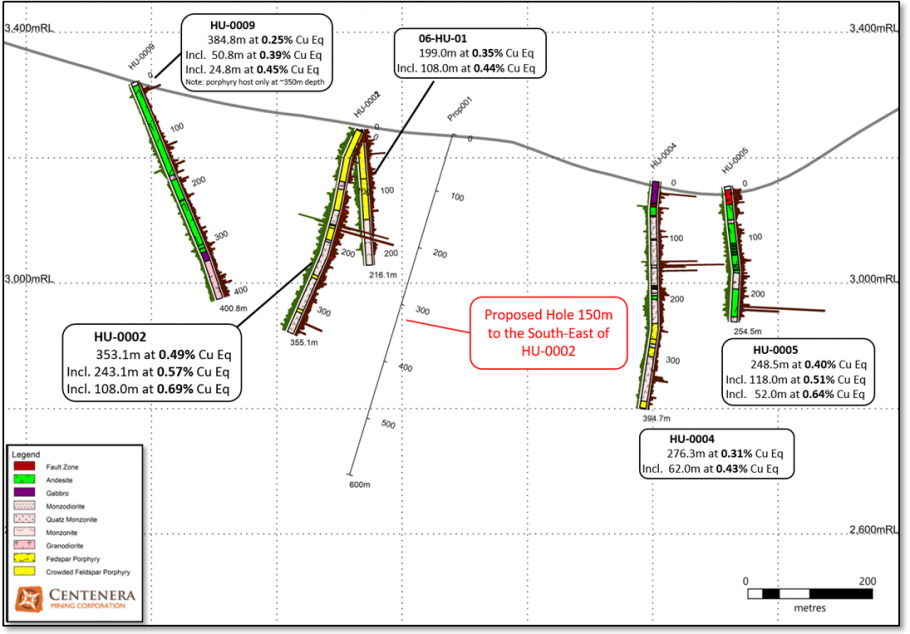

"We are announcing our new project name and we will now move quickly to put logistics in place for the drill program, beginning with an upgrade of the road to site. Mobilization is in progress and contractors are in place for the drill program," stated Keith Henderson, President and CEO of Centenera, "Previous drilling advanced the project significantly, demonstrating grade from surface and continuity at depth. The new drill program will investigate the tonnage potential of the deposit with holes planned to test deeper and stepping out approximately 150 metres from previous mineralized intersections."

Mineralized Copper-Gold Porphyry

The outcropping copper-gold porphyry mineralization at Esperanza was first drill-tested by Cardero Argentina S.A. (now a wholly-owned subsidiary of Centenera) in 2006-2007 with 7 diamond drill holes totalling 2,011 metres. All drill holes intersected significant copper-gold mineralization (Figure 1). Drilling highlights include:

- Best intersection is 353.1m1 from surface, grading 0.35% copper and 0.18 g/t gold (0.49% copper equivalent2) including 243.1m1 grading 0.40% copper and 0.21 g/t gold (0.57% copper equivalent2)

- Mineralization is outcropping at surface with a pyrite halo extending over a 1,400m x 850m area

- Drill holes generally intersected mineralization at surface

- Mineralization is open all directions

- Majority of drill holes terminated in mineralization due to the depth limitations of the drill rig and are open at depth

- Several drill holes demonstrate increasing grade with depth

Notes: 1 True width is not known. 2 Copper equivalent = copper grade % x (0.795 x gold grade g/t), where the conversion factor of 0.795 is calculated by comparing the value of 1 tonne of copper ore (at copper prices of $2.20/lb ($4,850.16/t)) to the value of 1 t of gold ore (at gold prices of $1,200/oz ($38.58g/t)) and assuming 100% recovery.

Readers are directed to the Company's technical report dated March 6, 2017 on the Project, San Juan Province, Argentina available on the Company's SEDAR profile at www.sedar.com for further information on the historical drilling on the Project.

Planned Drill Program

The objective of the current Esperanza drill program is to investigate the potential for a bulk tonnage, copper-gold porphyry style deposit. The Company plans to initially drill 4 drill holes for approximately 2,000m. The planned drill holes are expected to step out at least 150m from previous drill holes. Since previous drill holes are open at depth, planned holes will aim to reach 500m to 600m down hole. Access road upgrades and camp construction will begin immediately.

Figure 1: Section through the porphyry system at Esperanza showing the location of the first planned drill hole relative to previous drill holes.

Notes: 1 True width is not known. 2 Copper equivalent = copper grade % x (0.795 x gold grade g/t), where the conversion factor of 0.795 is calculated by comparing the value of 1 tonne of copper ore (at copper prices of $2.20/lb ($4,850.16/t)) to the value of 1 t of gold ore (at gold prices of $1,200/oz ($38.58g/t)) and assuming 100% recovery.

Esperanza Project Background

The Esperanza copper-gold mineralization is associated with a porphyry-epithermal system with extensive multiphase quartz-stockwork development. Historical exploration work on Esperanza identified porphyry style copper mineralization, which is best developed around two intrusive stocks: the Canyon stock and the Oro Rico stock. Both stocks have mineralization at surface consisting of chalcopyrite, with disseminated magnetite, pyrite, and local sparse bornite and molybdenum. Additionally, a large 1,400m by 850m elongate >3% pyrite halo overlies the prospect suggesting significant porphyry mineralization may remain untested under cover.

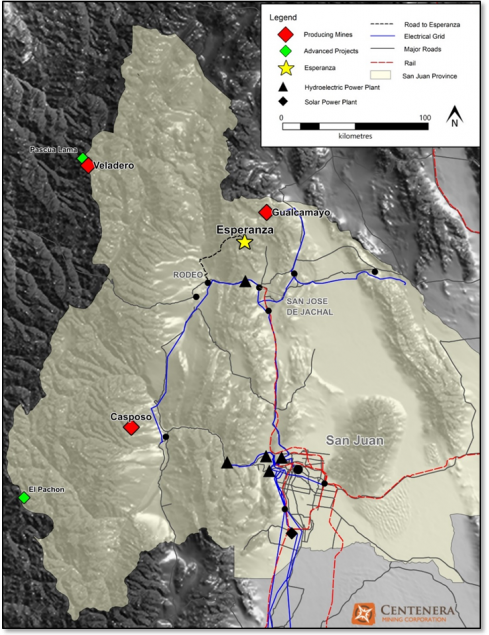

The Project is located in San Juan Province in northwestern Argentina, 135km due north of the city of San Juan. The Project is situated close to existing infrastructure, is within 35km of power lines and has year-round road access. It is located at elevations between 2,800m and 3,250m above sea level, which is low relative to other projects in the Andes (Figure 2). Exploration can be conducted year-round.

Figure 2: Location of Esperanza Project and Infrastructure

Under a binding letter agreement with the vendors (collectively, the "Vendor") of the Project (see news release of January 23, 2017), Centenera has the option (the "Option") to earn a 100% interest in the Project through the payment of USD $2,306,000 and the issuance of common shares in the Company valued at USD $500,000 (at the time of issuance) to the Vendor, subject to a 2% Net Smelter Royalty ("NSR") to be granted to the Vendor. Centenera will have a right to buy back 0.5% of the NSR for USD $1,000,000, at which time the NSR payable to the Vendor shall be 1.5%. During the Option period, Centenera will be responsible for maintaining the exploration concession and permits comprising the Project in good standing, and paying all fees and assessments, and taking such other steps, required in order to do so. There will be no other work commitments, and any work carried out on the Project will be at the sole discretion of Centenera.

Non-Brokered Financing

The Company also announces a non-brokered private placement (the "Financing") of up to 12,000,000 Units priced at $0.18 per Unit to raise a total of up to $2.16 million. Each Unit will consist of one common share of Centenera and one warrant, with each warrant entitling the holder thereof to purchase one common share of Centenera at an exercise price of $0.30 for a period of 18 months from the closing of the Financing. The common shares and warrants comprising the Units will be subject to a hold period of four-months and one day in Canada. The proceeds of the private placement are intended to be used to fund drilling at the Esperanza project and for general working capital purposes. The Company may pay finder's fees on a portion of the Financing consisting of a cash commission equal to 7% of the gross proceeds raised and finder's warrants equal to 7% of the total number of Units issued, where each finder's warrant will entitle the holder thereof to purchase one common share of Centenera at an exercise price of $0.18 for a period of 12 months from the closing of the Financing. The Financing is subject to TSX Venture Exchange and other regulatory approval.

This press release does not constitute an offer to sell or a solicitation of an offer to buy the securities described herein in the United States, or in any jurisdiction in which such an offer or sale would be unlawful. The securities described herein have not been and will not be registered under the United States Securities Act of 1933, as amended (the "1933 Act") or any United States state securities laws, and may not be offered or sold in the United States or to the account or benefit of a "U.S. person" (as defined in Regulation S under the 1933 Act) or a person in the United States absent registration or an applicable exemption from the registration requirements.

Stock Option Grant

The Company also announces that it has granted 6.6 million stock options to various directors, officers, employees and consultants of the Company and its affiliates. The options are exercisable by the holders to purchase common shares of the Company on or before November 20, 2020 at an exercise price of $0.20 per share.

Quality Assurance / Quality Control

The Esperanza copper-gold porphyry drill testing was undertaken by Cardero Argentina S.A. from 2006 to 2007. On site personnel at the project rigorously collected and tracked samples, which were then sealed and shipped to ALS Chemex for analysis. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025: 1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Quality control was further assured by the use of international and in-house standards. Blind certified reference material was inserted at regular intervals into the sample sequence by Cardero personnel to independently assess analytical accuracy. Finally, representative blind duplicate samples were forwarded to ALS Chemex and an ISO compliant third-party laboratory for additional quality control.

Qualified Person

Tyler Caswell, P.Geo., the Company's Exploration Manager and a qualified person as defined by National Instrument 43-101, has reviewed the scientific and technical information that forms the basis for portions of this news release, and has approved the disclosure herein. Mr. Caswell is not independent of the Company, as he is an employee and holds incentive stock options.

About Centenera Mining Corporation

Centenera is a mineral resource company trading on the TSX Venture Exchange under the symbol CT and on the OTCQB exchange under the symbol CTMIF. The Company is focused 100% on mineral resource assets in Argentina. The Company intends to focus its 2017 exploration activities on drill-testing its flagship Esperanza copper-gold project. Other assets, including the Organullo gold project and the El Quemado lithium pegmatite project in Salta Province, are intended to be explored by the Company with the aim of proving project potential and attracting a joint venture partner or a project sale. The Organullo project has approximately 8,000 metres of historical drilling and assay results. Organullo has a geological target range from 19.8 million tonnes grading at 0.94 g/t gold (600,000 ounces) to 31.6 million tonnes grading 0.92 g/t gold (940,000 ounces) using a 0.5 g/t gold cut-off-grade. It should be noted that these potential exploration target quantities and grades are conceptual in nature, that insufficient exploration and geological modelling has been done to define a mineral resource, and that it is uncertain if further exploration will result in the delineation of a mineral resource.

On Behalf of the Board of Directors of

CENTENERA MINING CORPORATION

"Keith Henderson"

President & CEO

For further details on the Company readers are referred to the Company's web site (www.centeneramining.com) and its Canadian regulatory filings on SEDAR at www.sedar.com.

For further information, please contact:

Keith Henderson

Phone: 604-638-3456

E-mail: info@centeneramining.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and U.S. securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the anticipated content, commencement, timing and cost of exploration programs in respect of the Project and otherwise, anticipated exploration program results from exploration activities, the Company's expectation that it will be able to enter into agreements to acquire interests in additional mineral properties or attract joint venture partners or sell its Organullo and El Quemado projects, the successful negotiation and execution of a definitive Option Agreement for the Project, the discovery and delineation of mineral deposits/resources/reserves on the Project, the closing and amount of the Financing, the intended use of proceeds from the Financing and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "expects", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward looking information. Such risks and other factors include, among others, operating and technical difficulties in connection with mineral exploration and development and mine development activities at the Project, including the geological mapping, prospecting and sampling program being proposed for the Project (the "Program"), actual results of exploration activities, including the Program, estimation or realization of mineral reserves and mineral resources, the timing and amount of estimated future production, costs of production, capital expenditures, the costs and timing of the development of new deposits the inability of the Company to prove project potential of the Organullo and El Quemado projects, to attract joint venture partners or sell any of its projects, lack of investor interest in the Financing the availability of a sufficient supply of water and other materials, requirements for additional capital, future prices of precious metals and copper, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, possible variations in ore grade or recovery rates, possible failures of plants, equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, delays or the inability of the Company to obtain any necessary permits, consents or authorizations required, including TSXV acceptance, for the Property acquisition, the Financing or in the completion of development or construction activities, changes in laws, regulations and policies affecting mining operations, hedging practices, currency fluctuations, title disputes or claims limitations on insurance coverage and the timing and possible outcome of pending litigation, environmental issues and liabilities, risks related to joint venture operations, and risks related to the integration of acquisitions, as well as those factors discussed under the heading "Risk Factors" in the Company's Management Information Circular (April 2016) and as discussed in the annual management's discussion and analysis and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company's profile on the SEDAR website at www.sedar.com.

Readers are cautioned not to place undue reliance on forward looking information. Except as otherwise required by law, the Company undertakes no obligation to update any of the forward looking information in this news release or incorporated by reference herein.